aubreysoderste

About aubreysoderste

Understanding the Switch of IRA To Gold: A Complete Research

The individual Retirement Account (IRA) is a well-liked retirement financial savings automobile that gives tax benefits to individuals saving for retirement. Historically, IRAs have been funded with stocks, bonds, and mutual funds. Nevertheless, lately, there was a growing curiosity in transferring IRAs into different assets, notably gold. This report explores the method, benefits, dangers, and issues concerned in transferring an IRA to gold.

What’s a Gold IRA?

A Gold IRA is a type of self-directed Individual Retirement Account that allows traders to carry bodily gold and different valuable metals as a part of their retirement portfolio. Not like traditional IRAs, which usually hold paper assets, a Gold IRA gives the opportunity to invest in tangible property, similar to gold bullion, coins, and other valuable metals.

Why Transfer an IRA to Gold?

- Hedge In opposition to Inflation: Gold has historically been seen as a safe haven asset throughout times of economic uncertainty and inflation. As the value of paper currency declines, gold usually retains its worth, making it a sexy choice for preserving wealth.

- Diversification: Adding gold to an investment portfolio can improve diversification. This can scale back general portfolio threat, as gold usually behaves differently than stocks and bonds, particularly throughout market volatility.

- Protection Against Economic Instability: In occasions of geopolitical tensions, financial crises, or financial downturns, gold has historically been a dependable asset that investors flip to for security.

- Tax Advantages: Gold IRAs provide the identical tax benefits as traditional IRAs. Contributions could also be tax-deductible, and investments can develop tax-deferred until withdrawal.

The Strategy of Transferring an IRA to Gold

- Choose a Self-Directed IRA Custodian: Step one in transferring an current IRA to a Gold IRA is to select a custodian that makes a speciality of self-directed IRAs and permits for the investment in treasured metals. It is essential to choose a reputable custodian that is compliant with IRS rules.

- Open a Gold IRA Account: As soon as a custodian is chosen, the investor should open a Gold IRA account. This typically involves filling out an application and providing needed identification and financial information.

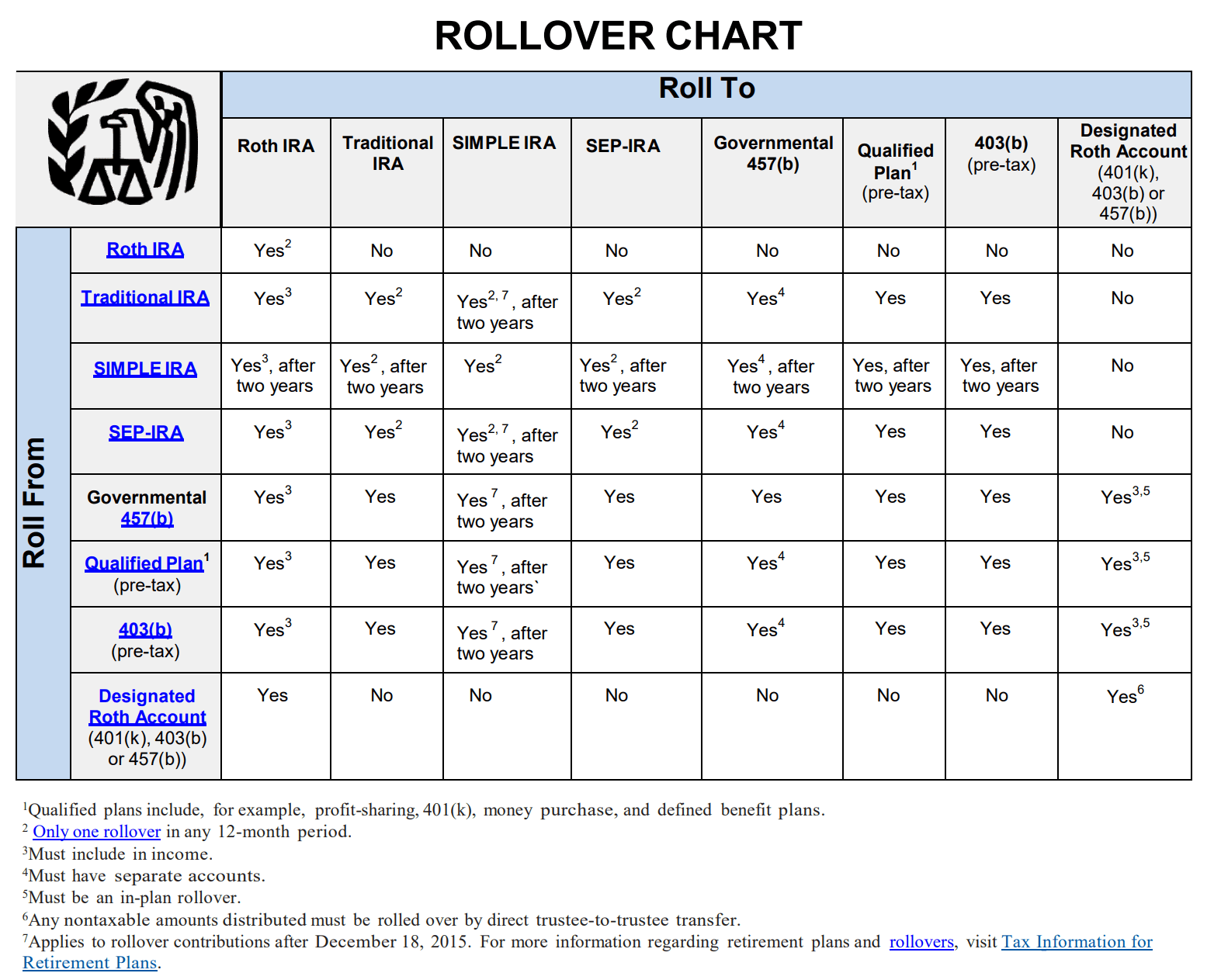

- Fund the Account: Traders can fund their Gold IRA by means of a rollover or transfer from an existing IRA. A rollover involves transferring funds from one IRA to a different, while a switch includes transferring funds from one account to a different with out the investor taking possession of the funds.

- Select Gold Investments: After funding the Gold IRA, investors can choose the particular gold merchandise they want to purchase. The IRS has specific pointers relating to the forms of gold that can be held in a Gold IRA, including sure gold coins and bullion that meet minimum purity standards.

- Storage of Gold: Physical gold have to be saved in an accredited depository to adjust to IRS laws. The custodian will usually arrange for the storage of the gold in a secure facility.

Advantages of a Gold IRA

- Tangible Asset: Unlike stocks or bonds, gold is a tangible asset that can be bodily owned and stored. This could provide a sense of safety for traders who prefer to have bodily management over their investments.

- Long-Term Value: Gold has an extended history of sustaining its worth over time. While prices might fluctuate within the brief time period, gold has consistently been a retailer of value over the long term.

- Liquidity: Gold is a extremely liquid asset, which means it can be easily bought or bought available in the market. This offers buyers with flexibility in managing their portfolios.

Dangers and Issues

- Market Volatility: While gold is usually seen as a safe haven, its worth can nonetheless be unstable. Traders should be prepared for fluctuations in the worth of their gold investments.

- Storage and Insurance Costs: Storing bodily gold can incur further prices, corresponding to storage fees and insurance coverage premiums. Buyers ought to issue these prices into their overall investment technique.

- Restricted Growth Potential: Unlike stocks, which can present dividends and capital appreciation, gold does not generate revenue. Investors should consider the potential for growth in other asset courses when allocating funds to gold.

- IRS Rules: The IRS has particular rules governing Gold IRAs, together with the kinds of gold that can be held and the requirements for storage. Traders should ensure compliance with these laws to keep away from penalties.

Conclusion

Transferring an IRA to gold can be a strategic transfer for traders seeking to diversify their retirement portfolios and hedge against financial uncertainty. Whereas there are quite a few benefits to investing in gold, it is essential to concentrate on the dangers and issues involved. By carefully choosing a good custodian, understanding the method, and making knowledgeable funding choices, people can successfully navigate the switch of their IRA to gold and potentially safe their monetary future. As all the time, consulting with a monetary advisor or tax skilled is advisable to ensure that the investment aligns with particular person financial targets and retirement methods.